Hey everyone!

For this month’s TheProductLed edition, I am excited to share 🥳

How to specifically map the components of Product-led Sales so that you can communicate to x-functional teams

How to use the MQL Funnel of Accountability to work better cross-functionally

💰 A free & simple forecasting template 💰 that helps get alignment on top-level targets needed to generate pipeline goals

Before we get into it, I want to say a couple of things. First of all, THANK YOU to you 🫶 .

I started this newsletter one year ago! It’s been incredible to connect with all of you in the PLG community.

Starting in 2024, I will start having guest authors! 🥳 Every month, a PLG expert will share valuable insights and real learnings that are actionable. The same folks who inspire me every day will hopefully get to do the same for yall!

Okay, let’s get into it.

I’ve been talking about Product-led sales (PLS) for over a year now. PLS is the new PLG if you haven’t heard by now. PLS is a strategic focus on driving enterprise pipeline, customers, and revenue expansion from self-serve growth motions. I’ve covered it many times:

👉 A few lookbacks:

When PLG and SLG get into a room - it’s all one dream team

The PLS Tunnel on connecting PQAs to the Enterprise Pipeline

My PLG Recaps

For this post, I’m not going to break down what is PLS. This wheel exists. Here are the two bible-like resources you can bookmark:

As a growth operator, I spend a lot of time in strategic communication, frameworks, and mapping. I’ve learned that it’s crucial to have a bird’s eye view of how your business monetizes value. If you don’t have the Birds Eye view, who will?

In this newsletter, I will map out my method for clearly explaining the evolution of PLS in its relationship to top-down MQL modeling so that x-functional teams understand how growth operates and encourage buy-in from cross-functional stakeholders.

It’s normal to face confusion and pushback when communicating with x-functional teams. Growth is taboo. Every company does it differently, and growth must be communicated to get buy-in and alignment.

There are two main GTM motions:

Bottoms Up Self Serve Funnel (PQLs).

Top Down Sales Funnel (MQLs)

The most common misconception in PLG is that self-serve cannibalizes enterprise revenue. This is false. (Figma, acquired for $20B has one of the strongest PLS motions in a big B2C market - read how they do PLS here).

However, let me explain when and how cannibalization can happen:

When there is no commitment to PLG - aka opening up freemium but stopping there. This is like putting your car in neutral so that you get some free-flowing motion due to a downhill gravitational force, but never putting the car back in drive when the downhill ends.

Lack of investment in activation and expansion of self-serve paid customers (how can you expand into Enterprise deal?)

Not providing an easy way for customers to hand raise to enterprise

Too big of a price differentiation between self-serve and enterprise tiers

Not differentiating pricing based on use case complexity or market size (enterprise, mid-market, SMB, prosumer)

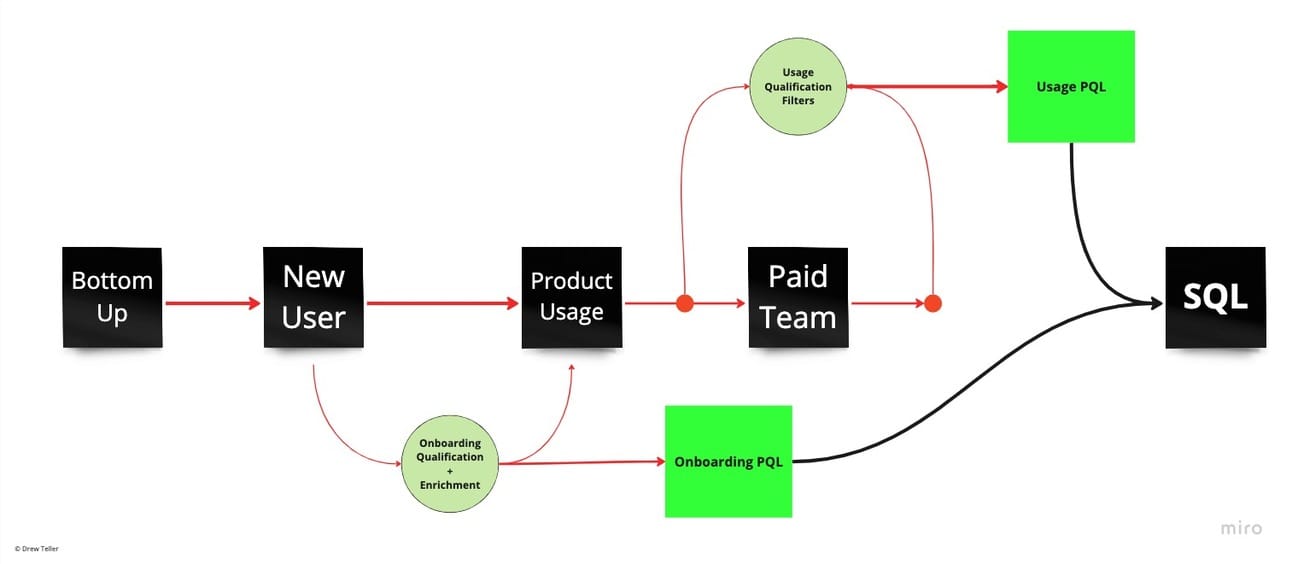

Here is my PLS map focused on what I famously called The Tunnel™:

Product Led Sales Tunnel

The goal of the Tunnel™ is to drive a large volume of Enterprise deals from the Self Serve (PLG) GTM motion in the form of PQA (product-qualified accounts).

Looking at the Tunnel™ diagram above, you can imagine that each line in this has a conversion rate from the step before to the step after. Each line is a form of plumbing. Think of each as a pipe that needs to be built. Each line has stakeholders and ownership. Each pipe leads to driving net positive revenue. Over time, you want to pour more water through each pipe.

The blockers of the fast water flow are when there is a crack, leak, boulder, or a lack of pressure. These manifest as lack of alignment, lack of ownership, or lack of commitment. This requires a meticulous view of the details and engineering of the plumbing system. Cross-functional teams may just see the inputs and outputs of each map, but it’s our job as growth operators to communicate the details and look under the hood to improve the model. Ignorance will not serve you or the company.

Bottoms Up - PQLs

PQLs are driven by primarily product-first signals and usage. If there are teams already using our product, this is 10 times more powerful than leads who don’t use your product. There are learnings to be discovered here.

If you don’t optimize for activation and retention (aka the beginning of the self-serve funnel), then the plumbing line from Usage to PQL is non-existent and THIS is when self-serve can cannibalize your enterprise motion. Not good.

By driving activation, you deliver value and self-serve revenue goes up AND the product-driven pipeline goes up.

Here are 2 kinds of PQLs to start your product-led sales motion in a young PLG company:

Onboarding PQLs

Usage PQLs

Onboarding PQLs - high-value ICP free sign-ups that are triggered based on onboarding results upon sign-up. These are usually:

from use cases that are “work” related

when a user is in a “senior” level role, or

when the company size is enterprise.

A usage PQL is usually a paid team with high usage or revenue (if usage-based). To create a V1 of a usage PQL model, start by creating basic filters for features and usage of your product. Preferably closer to the enterprise ICP side of the spectrum. Make a dashboard or a table and then one SDR work these via outreach.

Here is a simple PQL map that I use to communicate with x-functional teams using the two PQLs I mentioned above.

PQL Mapping for x-functional teams

By mapping each part of the PLS funnel using PQLs, you can attach conversion rates at each step. Once mapped out and measured, you can manage it. It’s important to visualize the complexity of PLS (PQL mapping) because it’s a new field. It has not been massively adopted, despite its success.

Be patient and continue pushing the needle!

I usually try and model up to 30-40% of the pipeline attributed to PQLs in a mature PLS model. If you’re just getting started, shoot for 10%. You will learn pretty quickly if you need to modify your forecast or your PQL scoring model based on how well SDRs can close these leads.

Top Down - MQLs

MQLs are a bit trickier. There is a lot of error, bias, and operational challenges with MQLs → read more on The Seven Deadly Sins of MQL Stuffing: #hottake

Since MQLs are arbitrary based on sales and marketing collaboration, teams either over-qualify or under-qualify in the MQL model.

When leads are overqualified, you will make the sales team waste too much time. When leads are underqualified, you are losing out on potential revenue. Both are important and it’s crucial to work closely with your SDR/Sales team to get feedback on this process. They are your sounding board in this space!

With aggressive growth targets, marketing and sales teams will both default to nebulous metrics of driving more top-of-funnel (quantity over quality). Growth and efficiency cannot happen simultaneously. It’s tricky and it’s not easy.

While this is normal, the work doesn’t stop here.

There are ways to improve this!

I believe there are 3 major parts of the MQL funnel. I call it the MQL Funnel of Accountability. Each piece has its impact on the bottom line. Each piece has its ownership and accountability.

👉 The three parts are:

Demand Generation (⅓ of the weight)

Demand Capture (⅓ of the weight)

Operations (⅓ of the weight)

Visually, the funnel looks like this:

MQL Funnel of Accountability

Demand Generation

Demand Generation (DG) is a term within marketing teams that has evolved over the years. It has been synonymous with being 100% responsible for driving marketing-influenced pipeline. This is not the case. Let me explain.

Demand Generation (DG) is only ⅓ of the impact on the MQL pipeline.

DG only explains where your leads come from. These are marketing channels, usually reported using attribution. Examples are paid, organic, direct, referral, etc.

It’s incredibly important to communicate to cross-functional teams the nuance here. Over the last 2-3 years, I’ve spent a lot of time compartmentalizing the difference between Demand Generation and Demand Capture. Let’s keep going…

Demand Capture

Demand Capture (DC) is about how your leads are captured. These are not marketing channels. These are actions users take to enter your CRM.

👉 Examples are:

Form fill on a website

Free sign up

Free trial

Request demo

Contact sales

Content download

Event

Webinar

DC is all about moments of conversion or moments where the user takes action. DC is about conversion rate optimization. This is why it’s so important to focus on website conversion rate, website layout, and content.

The biggest impact you can make on acquisition is to improve the bottom-of-funnel website conversion rate, rather than a specific demand-gen channel.

If you only focus on traffic and not how you capture that traffic, you will not scale. Period.

Operations

👉 Operations consist of 3 things:

Lead scoring (MOPs)

Lead enrichment (MOPs + Sales)

Lead routing (SOPs)

Operations is co-owned by marketing ops and sales.

Operations is a crucial part of the conversation. They are usually neglected in their impact from driving MQLs and deals to the sales team. While a good sales team manages this effectively, it’s important to bring this into the conversation when talking about how to optimize the MQL-driven pipeline.

👉 For example:

If you have 100 leads that have big logo names attached to them that have not MQL’d → This is an enrichment problem.

If you have 100 leads that have engaged with a lot of content and used the product but have not triggered an MQL → This is a scoring problem

If you have a ton of MQLs but very few conversations → This could be a routing problem.

All of these parts in operations within the MQL Funnel help improve the pipeline efficiency. My suggestion is to review each of these quarterly.

For lead scoring, run a % error stress test. Comb through all leads that look qualified but never triggered the MQL. If this number is above 10%, I’d consider modifying the scoring model if the lift is not too big.

In summary, the purpose of mapping the MQL Funnel in this way is to visualize where accountability lies and a better effort to create an ownership culture.

In my experience, many cross-functional issues get resolved when you come together as a team to go over how all of our areas of expertise contribute to the overall goal.

Marketing, sales, and growth teams should consistently be evolving the MQL scoring model to ensure:

Qualitative and quantitative feedback loops are strong

Consistent improvement in conversion rates

Experiment with new ideas and marketing strategies

—

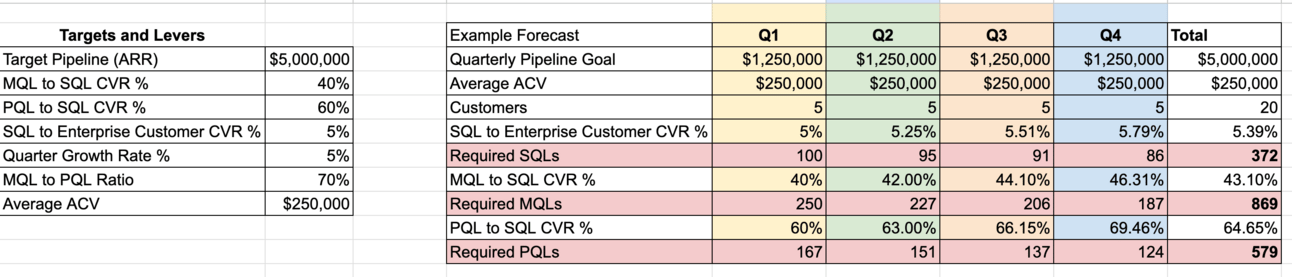

🔥 Simplified Growth Model Template 🔥

Do not agree to a pipeline target without modeling out what it takes to get there!

If you have a lot of data, great. Most startups have to make a lot of assumptions. Even with a simple model like this one, you can understand the feasibility of your growth.

👉 How to use the MQL and PQL Pipeline Template:

Set your targets, conversion rates, and growth assumptions on the left

This model assumes a linear change QoQ, but you can modify

The model spits out the required MQLs and PQLs per quarter needed to generate pipeline ARR target

Take the Required MQL number back to the marketing plan and budget accordingly (run CAC payback, figure out digital spending, etc)

Take the Required PQL number back to the product growth team and level set on the number of activated and converted teams needed to generate target PQLs

Wrapping up

Dual go-to-market motions require meticulous tracking and mapping of where all influenced revenue will come from. By applying data and metrics to each part of the map, x-functional teams can better own and collaborate

Be sure to model out the required MQLs and PQLs needed to hit your growth targets

MQL optimization consists of 3 parts:

Demand Generation

Demand Capture

Operational Efficiency

Lead Enrichment

Lead Scoring

Lead Routing

PQL optimization starts with the beginning (Onboarding PQL) and the end (Usage PQL)

Thanks for taking the time to stop by today!

Was this forwarded to you? Subscribe with one click.

If you're finding this newsletter valuable, please share and spread the word if you can!

See you next year 👋